One salient issue dominating discussions in Nigeria today is President Bola Ahmed Tinubu’s tax reform bills. Some Nigerians believe that these bills were designed to benefit Lagos and Rivers States, while impoverishing other regions, particularly the northern states where citizens already face extreme poverty.

Borno’s Governor Babagana Zulum warned that if passed in their current form, these bills would render many states, including his own— still grappling with the Boko Haram insurgency— incapable of paying workers’ salaries.

Granted, tax reforms and, by implication, widening the tax net is undeniably essential for Nigeria, but its implementation, coming at a time when the citizens are struggling to survive the intolerably high cost of living, must be approached with caution.

Reforming the tax system is both necessary and inevitable, and the current period offers a crucial window for action.

A Call For Wider Consultation

Despite the urgency, radical tax reform cannot succeed without thorough, inclusive public debate. Democracy thrives on citizens’ freedom to influence policies that affect them. Ideally, the crafters of these bills should have prioritized extensive consultation, aggressive public awareness campaigns, and public hearings through town hall meetings before submitting the proposal to the National Assembly.

The lack of these preliminary steps has fueled widespread suspicion among Nigerians, especially as opposition to these bills comes even from governors within the ruling All Progressives Congress (APC). The criticism from APC members underscores that these reforms were neither part of the party’s manifesto nor explicitly part of PBAT’s campaign promises.

Had these reforms been presented during the campaign, northern voters who contributed over 60% of PBAT’s electoral victory might have either reconsidered their support or known beforehand what to expect since they massively voted for him.

Given the interest the proposed tax reform has generated, allowing Nigerians – not just the National Assembly – to debate these bills effectively will build public trust and ensure inclusivity in policymaking.

Without being cagey, issues with significant national implications such as tax reforms demand extensive consultation. The government must provide platforms for diverse opinions, which will ultimately help in ensuring broad-based support. Nigerians deserve more than a token invitation to await deliberations from a “rubber-stamp” legislature.

After all is said and done, I can bet with my last penny that the National Assembly will pass the tax reform bills, and PBAT will sign it without hesitation.

Trust deficit

In the face of dwindling revenue, Nigeria must do all it takes to boost its cash inflow. Reforming the nation’s tax system is undoubtedly one of the diverse ways of boosting government income.

While increasing revenue is vital, Nigerians are sceptical about the judicious use of public funds, especially amidst rampant corruption. Concerns over mismanagement and theft of public resources make tax reforms contentious, as many believe additional revenue would only enrich corrupt officials. The scale and magnitude of corruption, especially in the public sector, often justify the citizens’ concerns.

One significant challenge that has continued to affect Nigeria negatively is the pervasive nature of corruption. No nation in the world is wholly corruption-free. Still, when the malaise is as endemic as it is in Nigeria and some African countries, undermining public finances, business investments, and citizens’ living standards, it calls for deep introspection.

Transparency International ranks Nigeria 145th out of 180 countries in its 2024 Corruption Perception Index. Similarly, a PwC report predicts that unchecked corruption could cost Nigeria up to 37% of its GDP by 2030. Reports like these present significant challenges to anti-graft agencies.

The Largest Recovery

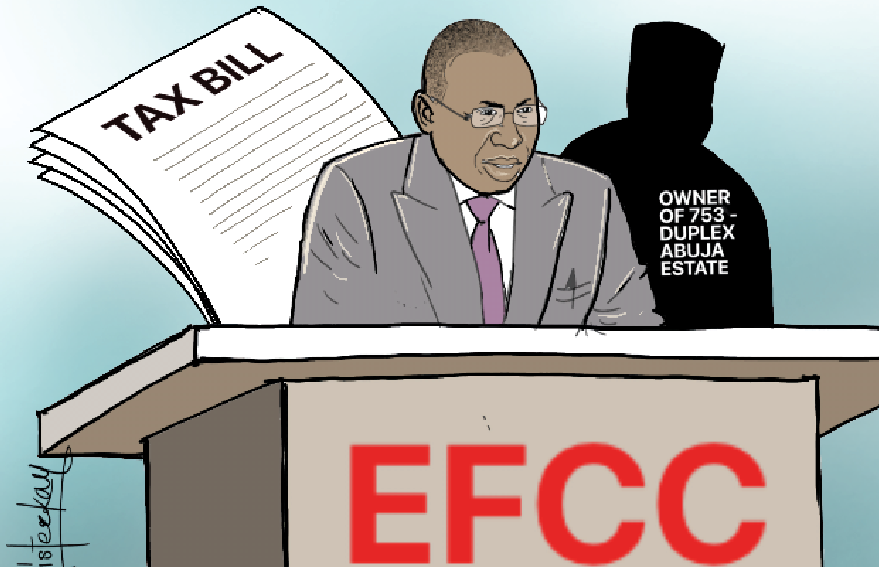

The issue of corruption and public trust takes us to what is now considered as the largest recovery in the nation’s anti-graft history. In a major breakthrough, the Economic and Financial Crimes Commission (EFCC) secured its largest asset recovery since its establishment in 2003. Justice Jude Onwuegbuzie ordered the forfeiture of a sprawling estate in Abuja containing 753 duplexes and apartments. Spanning 150,500 square meters in Abuja—a city where land is a premium—this estate was built using proceeds of crime by an unnamed public official with unfettered access to public funds.

While this recovery underscores the EFCC’s commitment to fighting corruption, it also highlights systemic weaknesses. That one individual could amass such wealth illicitly speaks volumes about the general failure of our system. The alarming reality is that this case may represent only a fraction of similar abuses by past and present public officials.

Needed: Full disclosure

EFCC said the estate belongs to a former top government official without mentioning who this ex-official is. Why was the anti-graft agency silent on who owns the estate? Why is the EFCC shying away from naming and shaming corrupt persons? Do Nigerians not deserve to know who owns this estate since it has been confirmed to be proceeds of crime from someone who once held public office and had access to our common patrimony?

This needless secrecy is one reason most Nigerians don’t trust the government’s much-talked-about anti-graft war. According to a survey by the United Nations Office on Drugs and Crime (UNODC), Nigerians’ confidence in the government’s anti-corruption effort has declined. In 2023, less than a third of the citizens have lost confidence in the government’s anti-graft war.

I still cannot fathom why the EFCC did not disclose the identity of the estate’s owner. Why this secrecy? Nigerians deserve to know who misappropriated their commonwealth. Concealing such details erodes trust in the government’s anti-corruption efforts.

The EFCC must name the public official to rebuild trust and expose all accomplices. Beyond naming them, the nation must ensure justice is served with penalties that are commensurate to their crimes. Nigerians need transparency and accountability in governance to restore faith in the system.