The CBN has provided clarification on the recent automated teller machine (ATM) charges introduced The apex bank noted that Nigerians withdrawing less than N20,000 from another bank’s ATM will be charged N100 per transactionThe new ATM charges regime will kick off in March and banks have been instructed to ensure there is cash available for customers

The Central Bank of Nigeria (CBN) has updated guidelines on Automated Teller Machine (ATM) transaction fees, slated to come into effect from March 1, 2025.

According to a Frequently Asked Questions (FAQ) document released on Thursday, February 13 customers withdrawing less than N20,000 from another bank’s ATM will face a standard charge of N100 per transaction.

The CBN confirms N100 charges on ATM withdrawals

Photo credit: Bloomberg

Source: Getty Images

This directive, outlined in a CBN circular dated February 10, 2025, aims to streamline ATM usage and deter customers from making multiple small withdrawals to circumvent fees.

In the document, the CBN also said withdrawals from one’s own bank’s ATMs will remain free of charge under the revised fee structure.

Read also

CBN instructs Access, Zenith, UBA, other banks on ATM withdrawal limits below N20,000

However, withdrawals from other banks’ ATMs will attract a N100 fee for transactions of N20,000 or less at on-site locations affiliated with bank branches.

For off-site ATMs, situated in venues like shopping malls or fuel stations, an additional surcharge of up to N500 per transaction will apply.

International ATM withdrawals will be subject to cost recovery charges, reflecting the exact fees imposed by international acquirers, Punch reports.

More clarification on ATM charges

The CBN also said that financial institutions are now allowed to exceed these stipulated fees.

Banks can however choose to lower charges as part of their business strategies.

The CBN also asked customers restricted from withdrawing above N20,000 despite adequate funds to lodge complaints with the CBN Consumer Protection Department via [email protected].

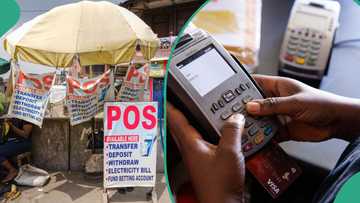

To avoid transaction fees, the CBN advised consumers to prioritise ATM usage at their primary bank and explore alternative payment channels such as mobile banking apps, Point of Sale (POS) transactions, and electronic transfers.

Read also

GTBank removes PoS processing fees as operators move to hike costs amid new ATM charges

PoS scams on the rise

Henzodaily.ng reported that data from the Nigeria Inter-Bank Settlement System (NIBSS) revealed that PoS transactions are on the rise and it is driven by a persistent cash shortage at ATMs and the rapid expansion of PoS deployments by fintech firms.

The N18 trillion recorded in 2024 represents a 69% increase from the N10.7 trillion processed in 2023.

Likewise, transaction volume rose by 8% year-on-year, reaching 1.5 billion in 2024, up from 1.4 billion the previous year.

PoS operators raise withdrawal, deposit fees

Also, it was reported earlier that PoS operators across Nigeria have started implementing new withdrawal and deposit fees.

Some operators who spoke to Henzodaily.ng said the changes were a response to current cash scarcity and the decision by the Central Bank of Nigeria decision to limit PoS operators’ cash withdrawals to only N100,000 daily.

Read also

Starlink, Spectranet, other Internet Service Providers hint at new data prices after MTN

Another reason given was the introduction of the N50 Electronic Money Transfer Levy (EMTL) charge on every N10,000 deposit in their customers’ accounts.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Henzodaily.ng