The commencement of the N50 Electronic Money Transfer Levy (EMTL) has attracted a myriad of directionsThe development came as fintech firms such as Opay, Palmpay, Moniepoint, and others began the EMTL charge this monthHowever, some transactions are exempted from the EMTL charges, including transfers under N10,000 and those within the same financial institution

Henzodaily.ng’s Pascal Oparada has reported on tech, energy, stocks, investment and the economy for over a decade.

Nigerians have reacted to the commencement of the N50 Electronic Money Transfer Levy (EMTL) on transactions in financial technology companies such as Opay, Palmpay, Moniepoint, and others.

The fintech firms notified users on Sunday, December 1, 2024, that the charges would commence on Monday, December 2, 2024.

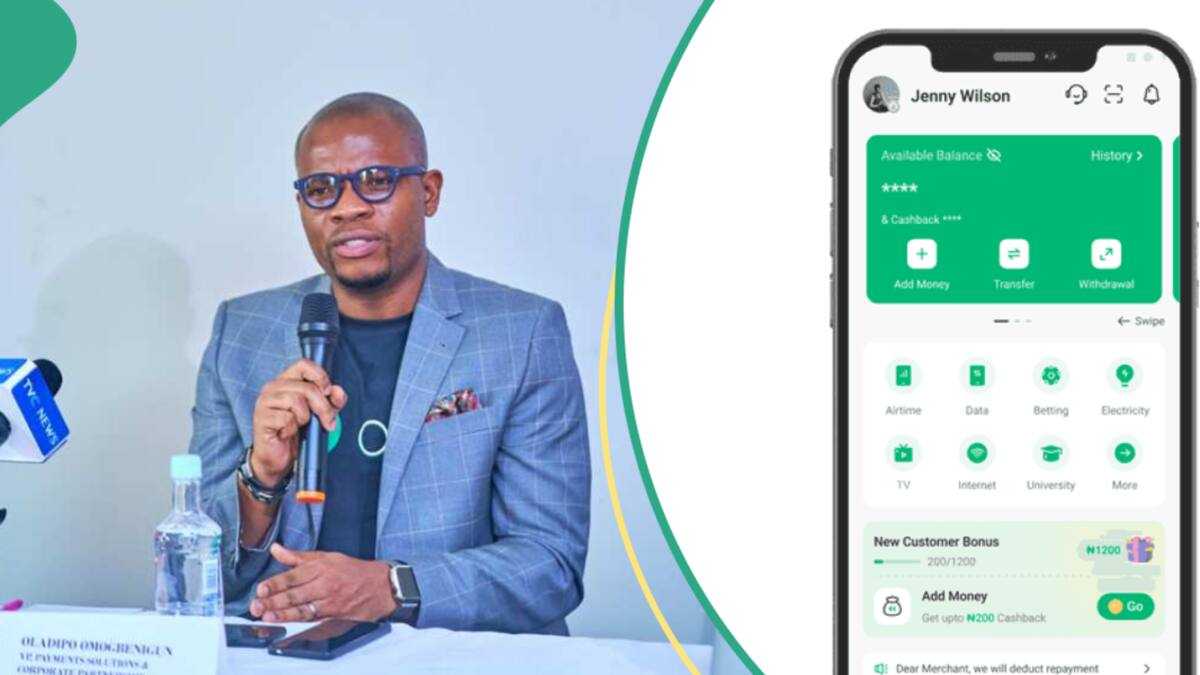

Opay, Palmpay, Moniepoint and other fintechs begin EMTL charges

Credit: OPAY

Source: Facebook

PoS operators hike charges

Henzodaily.ng earlier reported that the companies had scheduled to begin the new charges on September 9, 2024, but was delayed due to outcry among Nigerians.

Read also

NNPC invites stakeholders to tour Port Harcourt refinery, speaks on operation

According to company messages, the EMTL is a one-off N50 charged on every transaction from N10,000 and above.

The EMTL was ordered by the Federal Inland Revenue Service (FIRS) on behalf of the Nigerian government and aligns with the 2020 Finance Act.

Fintech platforms disclosed that the move complies with the Nigerian Stamp Duty Act, asking them to charge N50 for every N10,000 and above on the recipient’s accounts

This development has led Point of Sale (PoS) operators to increase their charges, as they say the new directive has impacted them.

They reveal that any money sent into their accounts would attract N75 extra charge as the EMTL would also be charged to their accounts.

According to them, when they receive money from anyone on behalf of their customers, they will incur an N50 EMTL charge, making them liable for the electronic transfer charges.

Read also

CBN finally addresses reported plan to retire 1,000 employees, offers N50 billion in pay-off

Types of transactions exempted from EMTL charges

They disclosed that they have to factor the EMTL into their charges to make a profit.

Meanwhile, some transactions are exempted from the EMTL charges.

According to the 2023 Finance Act, transfers under N10,000 and below and accounts within the same financial institutions are exempted from the EMTL charge.

Collecting and remitting the Levy involves financial institutions collecting the levy on each qualifying electronic transfer, and remission is expected to be made to FIRS within the stipulated time.

FG orders fintechs to start N50 deductions

Henzodaily.ng previously reported that fintech companies such as Moniepoint, Palmpay, and others had begun informing their customers about plans to implement the N50 EMTL.

This deduction would apply to every inflow of N10,000 or more received by customers starting Monday, September 9, 2024.

According to the fintech companies, this deduction is in accordance with the Federal Inland Revenue Service (FIRS) directive.

Read also

Banks announce new cash withdrawal limit for customers as POS operators adjust charges

Proofread by Kola Muhammed, journalist and copyeditor at Henzodaily.ng

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Henzodaily.ng