A man who was formerly a banker in Nigeria before he migrated to the United Kingdom has frowned at the federal government’s electronic transfer levy (EMTL)According to the ex-banker, he realised that there is nothing like an electronic transfer levy in the UKHe further highlighted some other things banks in the UK don’t do and compared them with their Nigerian counterparts

An ex-banker, @RealMrKay, has criticised the federal government’s introduction of the electronic money transfer levy (EMTL).

@RealMrKay, now in England, compared Nigerian banks with their UK counterparts by sharing a culture shock he experienced abroad.

He said banks in UK don’t charge customers any fee for electronic transfer.

Photo Credit: Bloomberg, X/@RealMrKay

Source: Getty Images

According to @RealMrKay, he realised that UK banks don’t deduct SMS charges, electronic money transfer levies, stamp duty, funds transfer charges, ATM maintenance fees, and excessive withdrawal/deposit fees from their customers’ accounts.

He described the fees Nigerian banks charge their customers as ridiculous. The ex-banker tweeted on X:

Read also

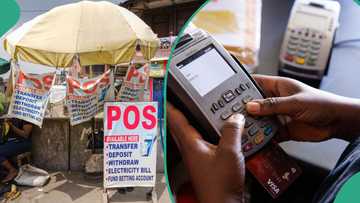

New PoS charges: FG gives marching orders to banks to tackle erring agents, cash scarcity

“I am an ex banker, I had a culture shock when I came to the UK and realised there’s nothing like;

“- SMS charge.

“- Electronic Money Transfer Levy.

“- ATM maintenance fee.

“- Stamp duty.

“- Funds Transfer charge.

“- Excess Withdrawal/Deposit fee.

“The fees are ridiculous.”

He urged the Central Bank of Nigeria to step up and wade into the excessive charges from Nigerian banks.

“The CBN needs to do something about it.”

Read his tweet below:

Ex-banker’s observation generates buzz on X

@sposhbaba said:

“You get charged from withdrawing from some ATMs in the UK. You get charged for cash deposits exceeding some amount. Nigerian banks are greedy, but banking in the UK is even more expensive!”

@Omobolanle12209 said:

“These banks are low key thieves cos there’s no way you’ll have exactly the same amount of money kept in your account due to their incessant deduction of these stupid charges.”

Read also

VDM blows hot, slams critics of NGO funds, shares account update: “I go show una I am a Big force”

@Ugez2 said:

“Why do you think they report ridiculous profit margins at the end of the year? And these charges aren’t fixed o, you might see one miscellaneous 30naira charge and won’t even have the strength to contest it. That N30 x millions of others too that wouldn’t contest it.”

Lady escapes N50 deduction, shares how

Meanwhile, Henzodaily.ng previously reported that a lady had transferred less than N10k thrice to an OPay account to avoid the N50 electronic levy.

From the screenshot she made public, the lady sent N9,820, N9,999 and N9,990 in quick succession to escape the levy.

The lady’s post on social media elicited mixed reactions, with some people tackling her for exposing the strategy

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Henzodaily.ng