The Nigerian government has taken over Keystone Bank following a court order forfeiting N6.3 billion sharesThe bank revealed in a statement on social media that the takeover will position it for greater and more robust growthThe takeover has led to massive fund withdrawals by customers as Keystone affirmed that it is financially healthy

Henzodaily.ng’s Pascal Oparada has reported on tech, energy, stocks, investment and the economy for over a decade.

Keystone Bank has disclosed that it is now fully owned by the federal government of Nigeria, saying that the takeover will boost its stability and facilitate a hitch-free recapitalisation process.

The bank revealed this in a statement on social media on Tuesday, February 11, 2025, following an order of the Lagos State High Court.

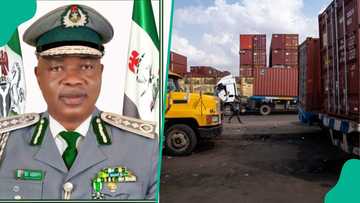

Olayemi Cardoso-led Central Bank of Nigeria (CBN) will supervise the affairs of Keystone Bank.

Credit: CBN

Source: Twitter

Court orders forfeiture of shares to FG

The court directed the forfeiture of shares previously owned by the bank’s former shareholders, transferring ownership to the Nigerian government.

Read also

Fidelity Bank gets approval to proceed with second phase of its capital-raising initiatives

The bank said.

“Keystone Bank Limited wishes to clarify the media report on a judgment by the Lagos State Special Offences Court, sitting in Ikeja, Lagos, on Tuesday, February 11, 2025, regarding the status of the former shareholders of the bank: Sigma Golf Nigeria Limited and Alhaji Umaru H. Modibbo.”

“At the court sitting today, February 11, 2025, the court ordered the forfeiture of the bank’s shares previously held by these shareholders in favour of the Federal Government of Nigeria.”

Keystone reaffirms its financial health

According to the bank’s statement, the development is crucial in reinforcing its stability and repositioning it for long-term growth.

Punch reports that Keystone said that with the new clarity, it is now properly positioned for sustained growth, stronger collaborations, and enhanced profitability.

The bank said it continues to boost its balance sheet while delivering value to its stakeholders.

It also reassured its customers of sound financial health and regulatory compliance.

Read also

Nigeria Customs Service introduces new levy as NPA raises tariff by 15% for imported goods

The Central Bank of Nigeria (CBN) dissolved Keystone Bank’s management alongside two others on January 10, 2024, leading to new ownership.

Costumes rush to withdraw funds

The news of the bank’s takeover sent panic to its customers as many besieged the bank’s branches to withdraw their funds.

Customers were seen thronging one of the bank’s branches along Iju Road in Lagos.

According to them, the news of the takeover scared them and they wanted to close or empty their accounts.

There have been speculations that the bank was distressed alongside others, leading to the CBN issuing a rebuttal, affirming the bank’s health status.

First Bank announces new name

Henzodaily.ng earlier reported that FBN Holdings Plc, a leading financial company, has rebranded as First HoldCo Plc (FirstHoldCo), a move aimed at creating a uniform identity across all its subsidiaries.

The change was announced in a statement released on Tuesday, February 11, 2024.

Read also

Nigerians to pay more for imported goods as NPA raises tariffs by 15% after 32 years

The statement further noted that the rebranding shows FirstHoldCo’s commitment to innovation, customer focus, and operational excellence.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Henzodaily.ng