Amid economic hardship, Nigerians battle with naira scarcity ahead of the Christmas and New Year celebrationsThe House of Representatives has expressed concern over the persistent cash shortage in commercial banks nationwideThe House in a fresh motion, urged the Central Bank to act swiftly to ease the hardship caused by the shortage of naira

Henzodaily.ng journalist Esther Odili has over two years of experience covering political parties and movements.

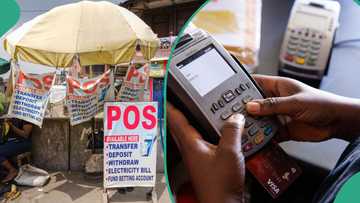

Amid a severe cash crunch, the Nigerian House of Representatives has demanded an investigation into commercial banks and point-of-sale (PoS) operators, urging the Central Bank of Nigeria (CBN) to urgently address the growing naira scarcity.

Reps take action on Naira scarcity as CBN, banks set cash withdrawal limit.

Photo credit: House of Representatives, Bloomberg

Source: UGC

CBN, banks set withdrawal limit

Henzodaily.ng reported that many banks reduced their withdrawal limits. Nigerian commercial banks, which gave N10,000 per transaction earlier in the week, reduced the cash withdrawal to N5,000 and N2,000.

This was after the CBN announced a daily cash withdrawal limit of N100,000 per customer for point-of-sale (PoS) transactions.

Read also

Nigerians, business owners react to CBN’s limit on PoS Ttansactions

Reps tell CBN to address naira scarcity

The Green Chamber has urged the Central Bank of Nigeria (CBN), led by Olayemi Cardoso, to take immediate action to alleviate the hardship the cash crunch has caused citizens.

In a motion presented under Matters of Urgent Public Importance by Uguru Emmanuel, the House emphasized the widespread economic and social challenges stemming from the cash scarcity, which has left many Nigerians struggling to access funds for essential needs.

Emmanuel stressed that economic growth depends significantly on consumer spending and business investments, both of which have been severely hampered by the ongoing cash crunch.

The lawmaker further raised alarm over the apparent disconnect between commercial banks and POS operators.

As reported by The Nation, he wondered where PoS operators get their cash from.

“Entrepreneurs and individuals are subjected to long queues, sometimes spending days at banks without success. This situation has particularly affected rural dwellers who rely on cash for transactions and lack access to digital payment systems,” he lamented.

Read also

GTB, Zenith, others announce new withdrawal limits as cash scarcity heightens

“Where do POS operators get their cash from while banks remain dry?” he queried.

Read more about the CBN, cash crunch here:

Stronger naira expected in 2025

Earlier, Henzodaily.ng reported that President Bola Tinubu expressed optimism that the naira would bounce back in the foreign exchange market in 2025.

Speaking at the presentation of the 2025 budget to the National Assembly, Tinubu said he expects the naira exchange rate to drop to N1,500/$1 in 2025.

Also, the president added that the current inflation rate of 30% will drop by half in 2025.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Henzodaily.ng